Helping Clients Exporting to the U.S. Realize Duty Savings Through First Sale Rule

February 2021

Proactive global attorneys should be advising clients exporting to the U.S. of a little-known U.S. tariff reduction strategy known as the first sale rule. First sale is especially important now that the incoming Biden administration is expected to maintain higher U.S. tariffs for many goods exported from the European Union and China.

Collaboration between you as counsel to the exporter and ST&R as U.S. customs counsel to the related or unrelated U.S. importer is essential to realizing these vast annual savings. This is a priority for businesses involved in international trade but particularly so during this difficult economic period.

If you would like to discuss this and other savings opportunities to determine if they might apply to your clients, please contact Charles (Chuck) Crowley, partner, ST&R at [email protected] or 914 433-6178 (cell).

This article summarizes the first sale rule and explains how it has been employed successfully for over 30 years with ST&R and foreign export counsel. It also describes a few of the reasons first sale is commonly not understood or employed by companies exporting to the U.S. and ways to help such companies adopt this program immediately.

Summary of the First Sale Rule

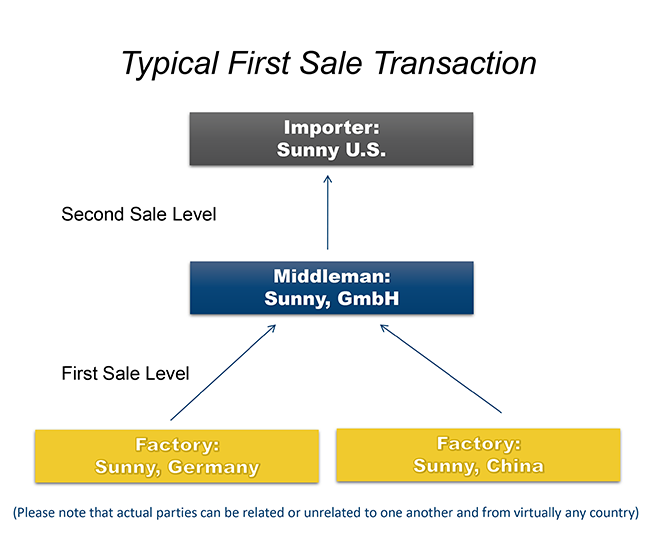

Under the first sale rule, the U.S. customs dutiable value of a qualifying transaction may be based on the purchase price between the middleman/vendor and the manufacturer rather than the price paid by the importer to the middleman/vendor, resulting in a significantly lower U.S. duty bill.

Various criteria must be met to use this method, including ensuring that the first sale price reflects a sale clearly destined to the U.S. and conducted at arm’s length. This rule was established in litigation by ST&R more than 30 years ago, and its legality and importance to the U.S. economy and trade community were reaffirmed by legislation first proposed by ST&R and enacted in 2008.

First sale has long been useful to industries subject to high U.S. tariffs, such as apparel and footwear, which use it to save millions of dollars in import duties each year. Its utilization has increased dramatically over the past few years as companies seek to lessen the impact of the Section 301 tariffs on imports from China; Section 201 and 232 tariffs on steel, aluminum, and other products; and tariffs on EU goods imposed in a long-running World Trade Organization dispute on aircraft subsidies.

Additional tariffs also remain a possibility on imports from France and other EU countries (due to their actual or pending digital services taxes) and automobiles and auto parts from many countries (following a Section 232 national security investigation).

Moreover, even normal duty rates are posing a challenge as companies forced to curtail or shut down operations due to the COVID-19 pandemic deal with reduced cash flow.

The time-tested first sale rule could help ease the burden of these measures, particularly at a time when volatility in trade policy has left some traditional methods of lowering costs unavailable and is threatening to eliminate others.

Beyond the current trade tensions and economic uncertainty, however, first sale can also serve as a type of long-term annuity; i.e., even once additional tariffs expire and businesses return to full operation, use of first sale valuation would, if properly maintained, continue to provide a lower declared value and thus reduce the regular duties assessed on a company’s products.

At the same time, companies must take care to ensure compliance with first sale requirements. U.S. customs authorities are scrutinizing imports that use this methodology more closely as part of a broader increase in enforcement efforts. The key is to take proactive steps to ensure that multi-tiered transactions meet first sale requirements and that there are internal controls and procedures in place to sufficiently document compliance.