Major M&A Customs and International Trade Considerations For 2021

Thursday, January 14, 2021

The need to review and analyze the customs and international trade practices of target companies in advance of merger or acquisition transactions is manifest. However, many professionals involved in M&A deals are generally unaware of the complex rules and recent developments governing the regulation of international trade or the need to the coordinate pre-acquisition due diligence compliance reviews with an experienced law firm engaged in the practice of customs and international trade law.

The failure to timely identify and remediate hidden potential liabilities can result in unexpected and costly post-closing surprises, including assessment of increased duty obligations and unanticipated administrative enforcement proceedings.

There are several reasons for this lack of coordination, and there are many ways it can be corrected by sophisticated global M&A professionals. This article will briefly discuss current customs and international trade topics that should be considered by legal, audit, tax, and consulting professionals to help avoid this significant and burgeoning liability.

Identifying M&A Import Risk

Many times, M&A professionals have been divorced from the complexities involved with target companies that import and/or export merchandise. Most M&A professionals are involved with transactions that have no exposure to complex import and export laws. This can leave even the most experienced M&A professional with a substantial lack of experience when analyzing the risks associated with the acquisition of companies engaged in the importation or exportation of merchandise on a global scale.

We are often asked:

"How can a target importer company not have sufficient controls, procedures, and processes to contain regulatory risk if it has been carrying on these activities without incident for a great period of time?”

The answer is that customs authorities, in today’s globally automated environment, increasingly rely on post-import audit and compliance verification programs to scrutinize the accuracy of entered classification, country of origin, customs valuation, and related declarations filed at time of entry. Many companies, for example, do not recognize the severe penalties involved with importing goods that may involve forced labor.

It is generally no longer the norm for U.S. Customs to verify regulatory compliance at the time of importation. For example, the Customs Modernization Act requires that all importers exercise reasonable care to ensure the accuracy and completeness of all declarations and documents filed with Customs. Failure by the importer to comply with these rules can result in serious consequences years later, including assessment of increased duties as well as claims for monetary penalties against both the importer and, at times, individuals who direct the activities of the importer.

The statutes of limitation permit U.S. Customs to consider enforcement action, including claims for monetary penalties, against entry filings made up to five years earlier and even longer in some cases.

Another reason for this common misunderstanding is the difficulty in ascertaining whether any one party is truly responsible for global customs and trade compliance, even in well-structured importing and exporting companies. In this regard, compliance with customs rules generally demands coordination with taxation, operations, legal, logistics, financial, IP, and regulatory compliance. This can be a daunting task.

Many M&A professionals may be aware of the risk of criminal sanctions and economic costs for violations of the Foreign Corrupt Practices Act. However, they are generally unaware of the consequences of U.S. Customs violations, which may result in assessment of civil penalties of 200% to 800% of the duty underpayment as well as a demand for payment of the additional duties owed.

Under the law, U.S. Customs can proceed with such claims for a minimum of five years after the occurrence of the alleged violation. Therefore, depending on the type of transaction, an acquisition can leave a buyer with mammoth liability for errors that occurred within this window. Depending on the level of culpability, violation of the customs laws may also result in criminal sanctions.

A Few Common Areas of Concern for Scrutiny

A common blind spot of importers and exporters of concern in the M&A arena is tariff exposure resulting from re-classification of imported merchandise, noncompliance with special trade programs, assessment of antidumping and countervailing duties, imposition of punitive tariffs, liabilities for misclassification and undervaluation of merchandise, and exportation of merchandise contrary to export control laws.

While the following does not review the myriad customs and trade risks involved in M&A transactions, we have highlighted a few that are especially critical in view of the current trade environment and U.S. Customs’ enhanced enforcement posture.

Section 301 for China

Many products imported from China are now subject to additional Section 301 tariffs. This makes it especially important to analyze customs and trade compliance where the target company is an importer or exporter. Companies subject to these tariffs have seen costs increase by 7.5% to 25%. That type of cost increase is challenging for earnings before interest, taxes, depreciation, and amortization (EBITDA), but non-compliance can also seriously increase costs and disrupt operations.

In a recent due diligence case, ST&R, acting in coordination with the M&A advisor’s due diligence team, determined that an exclusion from the Section 301 25% tariff did not lawfully apply to the company’s product. This discovery allowed the buyer to recognize that the actual tariffs owed were 25% greater than alleged by the target importing company.

Not only was the potential annual duty exposure much greater than the valuation reflected in this case, but the importer was also required to repay duties owed, plus penalties. Due to the coordination of the M&A advisor and ST&R, this error was identified before the deal was finalized.

Country of Origin

One of the other complicated and important subjects for M&A advisors to verify is the accuracy of the claimed country of origin. It is understood that U.S. Customs has recently increased its scrutiny of country-of-origin declarations, resulting in a major increase in formal inquiries, audits, and penalties.

On its face, verifying the country of origin of imported products would appear straightforward to most M&A advisors. Many would assume the origin is the last country in which the product undergoes a process of manufacture and/or from which it is shipped. However, many products today are made with components made in and shipped from a variety of countries, which complicates the country-of-origin determination considerably.

In response to the Section 301 tariffs imposed on a range of goods from China, some U.S. companies have shifted production to other countries in Asia, such as Vietnam, or to countries with which the U.S. has a trade agreement. However, declaring that products are “made in Vietnam” or “made in Mexico” when they consist of, for example, subassemblies shipped from China may not comply with U.S. country of origin rules. These rules generally require that a product undergo substantial transformation before a particular country can be declared as the point of origin.

Misidentification of the country of origin results in any number of adverse consequences, including assessment of punitive rates of duty, denial of duty preference claims, demands for redelivery, assessment of special marking duties, and institution of enforcement action for violation of the customs laws.

Tax Valuation versus Customs Valuation

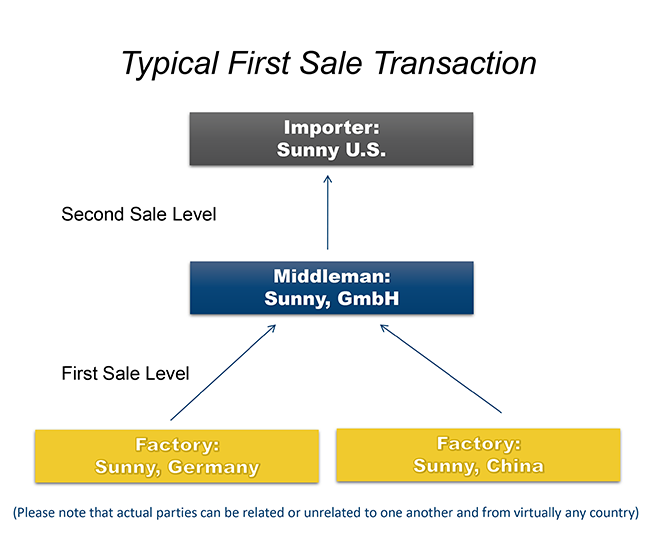

Another common mistake for M&A professionals reviewing target companies is to rely on skilled tax professionals who may not coordinate with customs legal professionals in determining value for duty purposes.

In this regard, tax professionals may be highly proficient in IRS transfer pricing but unfamiliar with customs appraisement rules and application of the customs value statute.

Many M&A professionals and their tax advisors assume that an identical value analysis can be adopted for an imported product for both customs purposes and IRS transfer prices (usually the price reflected on the invoice at time of importation). This is a common mistake that can lead to unfortunate results. Customs valuation rules, especially those involving related party transactions, can result in significantly different and opposing value determinations as compared to arm’s length valuation for tax purposes based on the IRS transfer pricing guidelines.

Aside from transfer pricing considerations, the appraisement of imported merchandise under the customs value statute is often complex. In the context of M&A transactions, it requires a clear-eyed examination by an independent customs expert as to whether all elements of value have been properly reported to the customs authorities. Undervaluation of imported merchandise can easily occur and result in the assessment of increased duties and possible institution of administrative civil penalty proceedings.

Exporters

The greatest exposure for exporters involved in M&A transactions is generally related to foreign tariffs, value-added taxes, FCPA, and U.S. export licensing issues. Exporters face major challenges in dealing with multiple federal agencies and highly complex regulations. When working with exporters, it is key to understand their complete supply chain.

It is also important to appreciate that U.S. export regulations are extraterritorial. A U.S. company with an overseas presence that exports products, even from another country, without an authorization or license, or transacts with a sanctioned party, may be subject to serious U.S. fines and penalties.

Even companies in seemingly innocuous industries, such as consumer goods, have paid substantial fines for dealings with sanctioned parties. Violations of the Export Administration Regulations can result in significant administrative penalties too, including denial of export privileges.

Conclusion

M&A advisors clearly need experienced global customs and trade counsel now more than ever due to the risks identified above. A proactive examination of the import/export compliance protocols and procedures of the target company as part of the M&A due diligence process helps insure against unexpected and costly post-closing surprises. Such a forward-looking examination also helps guarantee against the continuation of ongoing customs violations.

For more information please feel free to contact Charles “Chuck” Crowley at (914) 433-6178 (cell), (212) 549-0134 (office), or

[email protected] or your other ST&R advisor.